The Power Development Department boasts a 250 percent surge in revenue and a crackdown on theft. Yet, with an 800 MW deficit and failing infrastructure, the lights are still going out. Why financial gains haven’t translated into a reliable grid for the Valley.

By Riyaz Bhat

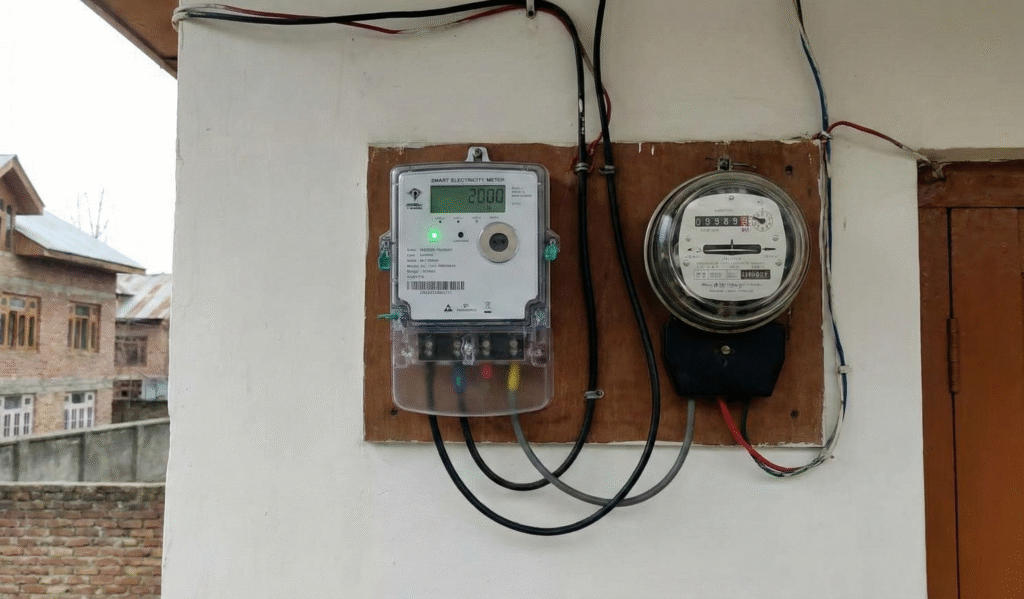

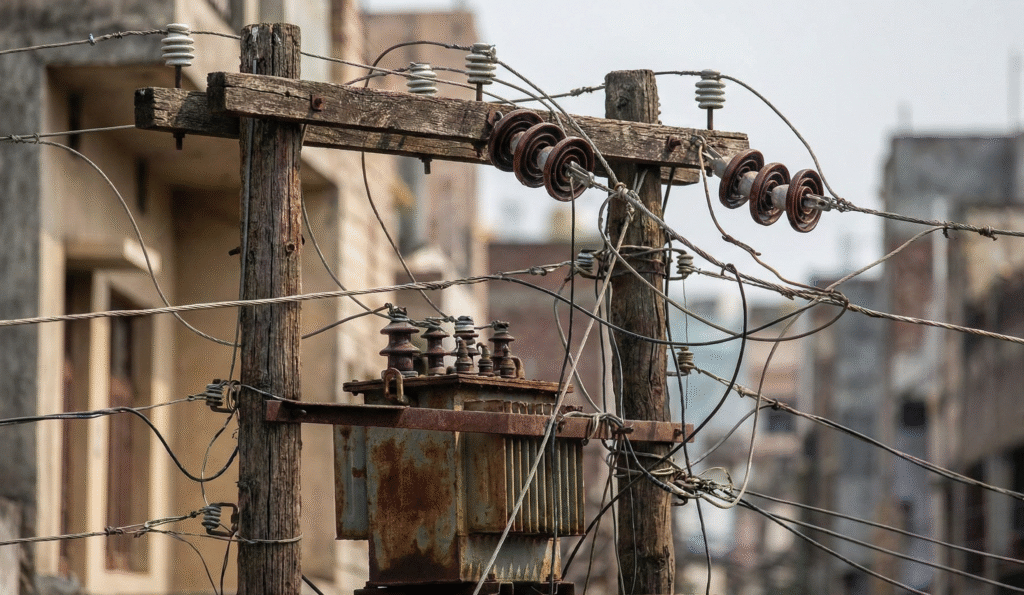

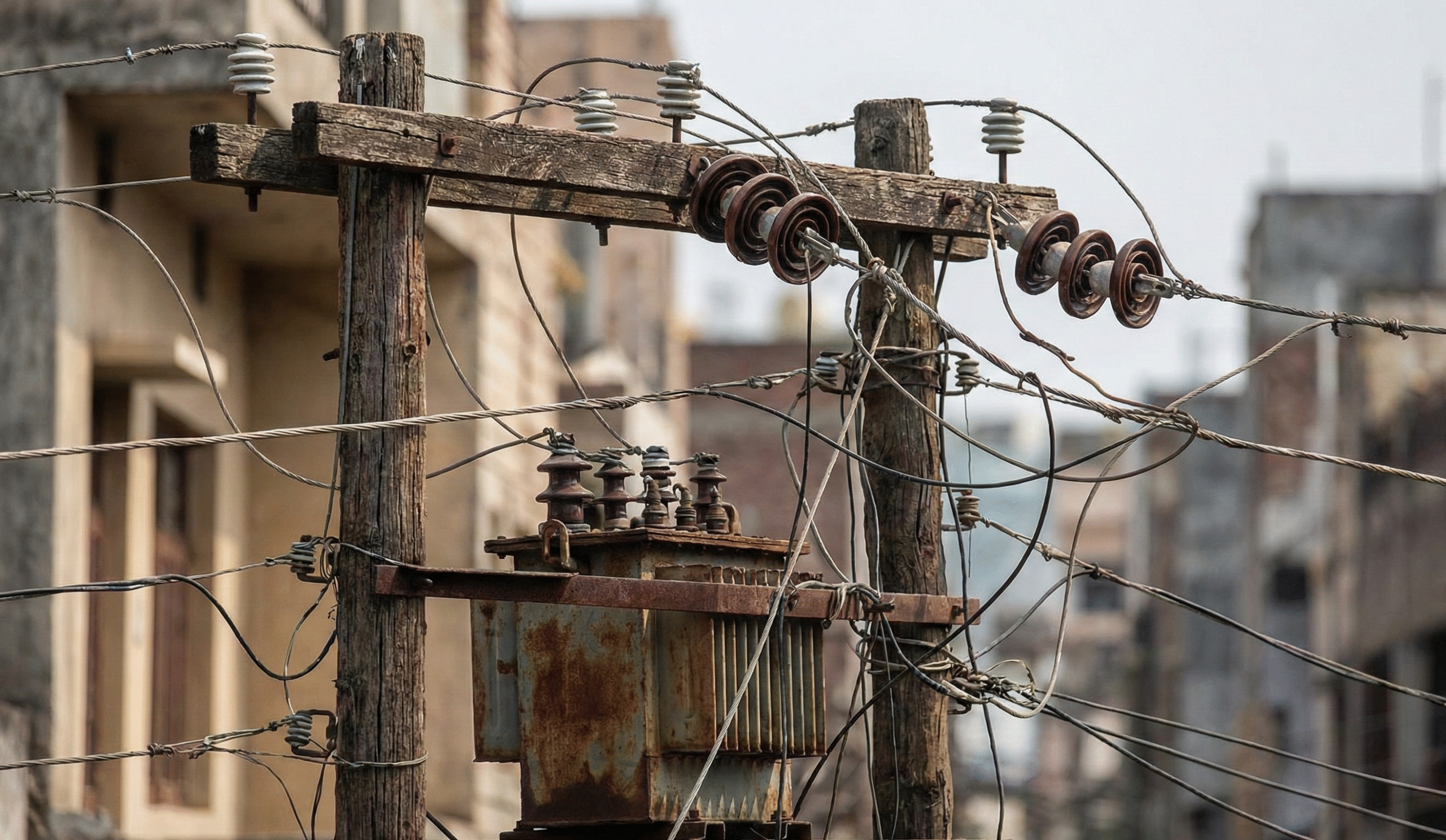

With the end of 2025, the power sector in Jammu and Kashmir has experienced cycles of increased dependency on imports, seasonal uncertainty in generation, and “decaying infrastructure” causing an unreliable power supply and public frustration. While the administration has made efforts to reduce outages and improve the financial position of the power sector through developments such as the installation of smart meters and infrastructure upgrades, the reality on the ground remains stark.

Previously, authorities had promised to double hydro-electricity generation by 2026, providing a glimmer of hope for a future of unrestricted power supply. However, the events of 2025 provide a more realistic view of how long and difficult it will be to achieve that future. Throughout the year, a series of reports and official documents have highlighted the systemic issues and developments defining the region’s energy landscape.

The Import Trap and Winter Deficits

The region’s inability to sustain itself during the harsh winter months remains the central challenge. By the third week of December, Jammu and Kashmir was importing over 95 percent of its electricity, a stark dependency that leaves the region vulnerable as it grapples with an 800 MW power deficit.

Officials informed that the region was importing electricity ranging from 2900 MWs to 3100 MWs during peak hours. It also noted that during other hours, the region is importing electricity ranging from 2400 MWs to 2800 MWs.

The demand-supply gap is widening. Another official noted that the actual power demand for the Kashmir region is around 2400-2500 MWs, while in the Jammu division, it varies from 1400-1500 MWs.

“As of now Jammu and Kashmir has a power deficiency of nearly 800 MWs. The total power availability as of now is 3100-3200 MWs,” he said.

This reliance is driven by the seasonal collapse of local generation. By February, reports indicated that Jammu and Kashmir was relying on over 85 percent of coal and solar power amid an acute deficit of hydropower generation. Officials of the Power Development Department (PDD) claim that generation from local power plants has reduced by nearly 90 percent.

A top official had informed that at present Jammu and Kashmir is 85-90 percent dependent on coal and solar energy that is being procured from other states because as of now it don’t have a local power generation.

Even during the lean season in August 2025, with minimal power generation availability, the region was procuring approximately 40-50 percent of electricity from imported power markets. Official documents reveal that due to non-availability of internal generation during winter months, Jammu and Kashmir imports power from the interstate network.

The immediate outlook for the current winter is grim. Amid persistent cold temperatures, Jammu and Kashmir and Ladakh are likely to witness a power deficit of over 34 percent in the month of December. Official figures reveal an availability of just 2460 Megawatts (MWs) against a requirement of 3737 MWs, resulting in a shortage of 1277 MWs.

Consequently, in the first week of December, the PDD was facing a shortage of nearly 500 Megawatts (MWs) to meet the actual power demand in the Kashmir valley, plunging residents into extended blackouts.

An official informed that in the first week of December, “The actual peak power demand in Kashmir is at least 2400 MWs but the local Discom (Kashmir Power Distribution Corporation Limited (KPDCL) this year so far has been able to cater only 1900 MWs.”

Infrastructure Woes and Technical Losses

Beyond supply shortages, the quality of power remains a persistent issue. Reports from 2025 indicate that the region reeled under persistent low voltage issues.

Official reports note that “Low voltage related issues of J&K and Ladakh (UT) have been regularly shared by NRLDC with CEA and CTUIL in Grid-India’s quarterly operational feedback report as well.”

“The issue has been continuously raised in NRPC as well as OCC meetings, still the issues of low voltage persist in J&K especially Kashmir valley,” the report reads.

This is exacerbated by specific transmission bottlenecks. Heavy power is being drawn by 400kV lines from Moga to Kishenpur during winter months, whereas the power flow on the 400kV Jalandhar-Samba line remains lower.

A critical technical failure is the “unhealthy power factor.” In the Kashmir valley, there are no power capacitors available for the local DISCOM to improve the quality of electrical systems by compensating for reactive power.

“In the meeting, it was informed from the J&K side that presently no capacitors are available in Kashmir DISCOM although capacitors have been provided by industrial consumers to keep healthy power factor,” reads the documents from the Ministry of Power (MoP).

The Ministry has discussed and suggested on numerous occasions to plan and expedite the commissioning of reactive power devices, especially capacitors at lower voltage levels, to improve the voltage profile in the valley area and avoid large sums payable as reactive energy charges.

Furthermore, the Northern Regional Power Committee (NRPC) found persistent unsatisfactory reporting status of Renewable energy (RE) from Jammu and Kashmir.

“Further, persistent unsatisfactory reporting status of Punjab and J&K was also highlighted,” reads the NRPC document.

The infrastructure struggles contribute to significant variations in grid stability. In late July, reports highlighted that in the backdrop of low voltage issues during the day time, Jammu and Kashmir is facing a variation of nearly 700 Megawatts (MWs) of power in comparison to other hours.

The Financial Equation: Revenues and Tariffs

Despite operational struggles, the financial health of the department has seen an uptick. The Jammu and Kashmir Power Development Department (PDD) has recorded nearly a 250 percent increase in revenue generation in the past five financial years. Since 2019-20 till the previous fiscal, PDD has collected Rs 16,974 Crore revenue from its consumers.

From the total revenue generated, the Kashmir Power Development Corporation Limited (KPDCL) saw a 176 percent increase, while the Jammu Power Development Corporation Limited (JPDCL) saw a 73.58 percent increase.

An official informed that “Power tariff’s share in non-tax revenue grew from 56 percent to 67 percent since Financial Year-22.”

“The proportion of these six revenue resources has increased from 86 percent in FY-22 to 93 percent in FY-25,” the official said, referring to major contributors like GST, power tariffs, and excise.

However, losses due to theft and inefficiencies remain high. The department was reeling under high Aggregate Technical and Commercial Losses (AT&C) with figures suggesting a loss of more than 41 percent till the financial year 2023-24. While JPDCL faced 31 percent losses, KPDCL struggled with 51.98 percent losses in the previous fiscal year.

To combat this, the government informed the Legislative Assembly in late October that the PDD was imposing a curtailment of four hours in those areas having the highest technical and commercial losses on local feeders.

Regarding these cuts, an official stated, “The power outages are primarily because of the unauthorised use of power. People mostly in the flat rate areas are not using power judiciously and that is one of the main reasons for the power tripping.”

“As of now 60 percent of the areas in Kashmir are flat rated.”

To manage demand, the PDD has proposed an extra 20 percent charge on electricity consumption during morning and evening hours in the Valley. The Kashmir Power Development Corporation Limited (KPDCL) has sought approval from the Joint Electricity Regulatory Commission (JERC) to impose a 20 percent surcharge on all categories of consumers except for the agriculture sector during peak hours.

A Decade of Deficits: The Long-Term Outlook

Looking ahead, the projections are daunting. Jammu and Kashmir and Ladakh are likely to witness an energy deficit ranging from over 4,200 MWs to 10,000 MWs in the next ten years.

“J&K and Ladakh are likely to witness energy deficit ranging from 4293 MWs to 9929 MWs in different years from 2024-25 to 2034-35 with the existing and planned capacity addition,” official documents revealed.

A study by the Government of India reads, “The study has analysed the daily and monthly pattern of unserved energy in the year 2034-35, it can be seen that contracted capacity (present and planned) is unable to meet the demand.”

“It was observed that the total unserved energy in the year 2034-35 is about 8730 MU,” it reads.

In a stark projection, reports indicate the region may face 29 percent of “forced load shedding” of annual power in the year 2034-35.

The demand is expected to skyrocket. Jammu and Kashmir is likely to witness growth in power demand by nearly 50 percent in a decade. Authorities have projected that the region will likely have an extra power demand by 49.42 percent by the year 2034-35, with peak demand growing by 6 percent each year.

To bridge this gap, the region is likely to require more than 4600 Megawatts (MWs) of power other than the planned capacities.

“As J&K is likely to have unserved energy in coming years there is a need to contract non-fossil capacities for meeting energy requirements other than the planned capacities. The additional quantum of capacities required (other than already planned) to be contracted is about 2438 MW from Coal, 1200 MW from solar, 987 MW of DRE till 2034-35.”

Over the past nine years, the region has already witnessed an average annual increase of 3.60 percent in electric power purchases.

An official noted, “When considered on a per capita basis, the growth rate stands at 2.45 percent per year, reflecting the region’s increasing energy demand. This growth is also in line with the region’s population increase, which has been growing at an annual rate of 2.14 percent during the same period.”

While the government focuses on initiatives like expanding hydel power plants and promoting rooftop solar panels, the documents suggest that with the present and other planned Power Purchase Agreements (PPAs), Jammu and Kashmir is unlikely to meet and cater to the power demand of consumers over the next nine years without significant strategic shifts.

For the immediate future, however, the region does have one advantage: seasonal surplus. Reports suggest that J&K and Ladakh have likely surplus capacity available from April to September in the range of 230-740 MW for 2027-28.

“This capacity can be shared with other states which might result in reduced fixed cost burden on the utilities resulting in further reduction in the cost for consumers,” the report reads.

As the administration grapples with these complex challenges, the “glimmer of hope” for 2026 faces the harsh test of rising demand and aging infrastructure.

“For satisfying resource adequacy that is meeting the electricity demand reliably and at affordable cost, the UT needs to methodically plan its capacity expansion either by investing or by procuring power,” the authorities concluded. (KNO)

Leave a Reply