Government Assures Public of Transparent Use of Property Tax Funds for ULBs. Property Tax Policy Exempts Places of Worship and Small Businesses

By Ajaz Rashid

The Government of Jammu & Kashmir has recently made an announcement that has caught the attention of the public. Effective from April 1st, 2023, the government will be imposing a property tax throughout the region. The news has been met with mixed reactions from the public, with some welcoming it as a necessary measure to generate revenue for the region, while others are expressing concerns over the potential impact on their financial stability. J&K Imposes Property Tax to Boost Local Finances and Development

This announcement has caused quite a stir amongst the public, with various factually incorrect and misleading pieces of information being circulated through the media, potentially leading to confusion and misguided decision-making. In response, the government has issued a statement urging the public to remain vigilant and not fall for any misleading information regarding the new tax. The government emphasizes that it is essential for the public to have access to accurate and comprehensive information, which will enable them to make informed decisions regarding the tax.

According to official sources, the new property tax will be imposed on all types of property, including residential, commercial, and industrial properties. The tax will be based on the market value of the property and is expected to be a significant source of revenue for the government. This has the potential to impact the lives and finances of millions of people, making it essential that they are aware of all the relevant facts and information.

In light of the confusion and misinformation surrounding the new tax, the government has announced that it will be launching a comprehensive awareness campaign to ensure that the public is aware of all the facts and implications of the new tax. The campaign is expected to include detailed information about the tax, its scope, and exemptions, along with other relevant details.

The government has also assured the public that all necessary measures will be taken to ensure a smooth transition to the new tax regime and that any concerns or grievances regarding the tax will be addressed promptly. It is essential that the public is aware of all the relevant facts and information and that they make informed decisions regarding the tax.

Jammu & Kashmir has been the only State/UT in India without a property tax, which has resulted in poor finances and limited resources for the Urban Local Bodies (ULBs) in the region. This has led to inadequate service delivery and the revenue generated from other sources accounted for less than 15% of their operational expenses. Due to limited funds for development, the government decided to impose the property tax in the region to break the cycle of low revenue and low service levels. The move is aimed at generating much-needed revenue for the development of the region.

A robust and effective system of local self-government is crucial for the successful functioning of a democracy. It is essential to have adequate finances at the disposal of the institutions of self-government, and the more these finances are mobilized at the local level, the better their effective functioning. Property tax is one of the essential pillars of municipal financing across the world. The Government of India, along with its Finance Commissions, has been recommending the tapping of this resource for some time now.

The Government of Jammu and Kashmir has announced the imposition of property tax in the Union Territory to strengthen the Urban Local Bodies (ULBs) and enhance urban development for the betterment of the masses. The government recognizes that development is impossible without adequate resources and sees the property tax as a means of augmenting its resources to enable the much-needed development of the region.

Government officials have strongly refuted concerns raised about the possibility of the government taking away the monies collected through the recently announced property tax in Jammu and Kashmir. They have assured the public that the monies collected will be retained by the Urban Local Bodies (ULBs) and used for their development needs. The ULBs will have complete control over the collected funds and will ensure that they are utilized for the betterment of the people in the region.

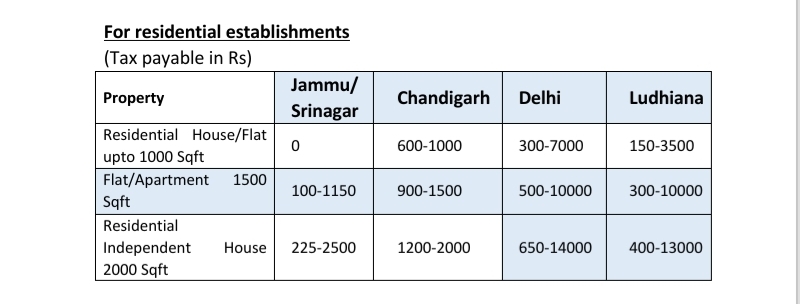

The tax rates for the recently proposed property tax in Jammu and Kashmir are not high and are actually quite reasonable. The tax will be levied at 5% of the Taxable Annual Value (TAV) of residential properties and 6% of TAV for non-residential properties. In fact, the tax rates in Jammu and Kashmir are some of the lowest in the country, almost half that of Himachal and one-fourth to one-sixth of other progressive states like Gujarat, Maharashtra, Karnataka, and Delhi.

The tax system is also progressive and takes into account various factors such as the age of the property, the use type, and the construction type, among others. Residential houses up to a build-up area of 1000 sqft have been exempted, and smaller assets are being taxed at lower rates. The taxable annual value has been linked to circle rates, meaning that the lower the circle rate, the lower the tax liability.

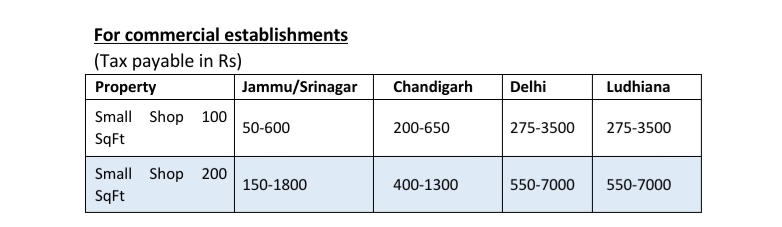

All places of worship, including temples, masjids, gurudwaras, churches, ziarats, etc., are exempt from paying property tax. Similarly, small commercial establishments, especially shops up to the size of 100sqft and 200 sqft, are also provided relief with very minimal tax implications.

The newly introduced Property Tax policy in Jammu and Kashmir is aimed at generating revenue for better municipal services while keeping the tax implications on residents to a minimum. As the tax will be levied annually and can be paid in two instalments, it is not expected to be a burden on the common citizen. Early submission of Property Tax can even lead to a 10% rebate, as per the Act.

The implementation of this policy is expected to attract more investment and encourage more people to set up businesses in J&K, as better municipal services will be provided with the revenue generated from property taxes. The funds will be utilized for improving infrastructure and enhancing the quality and level of services

Leave a Reply